Manage your budget like a Pro:

Every financial decision should start with a good budget plan. It begins by prioritizing expenses and recognizing those expenses that are necessary for a comfortable existence as well as those expenses that are not essential.

To make a budget like a pro start by having the following items in mind:

First, identify all sources of income that you or your household receives. Take in consideration to include salaries, alimony, interest earnings, dividends and other income sources.

Second, set your short- and long-term financial goals. It is very important to determine these objectives so you can periodically adjust your budget plan accordingly.

Third, identify how much money will be required to fulfill your goals and over what length of time.

Fourth, start cutting expenses in order to increase your savings and cash float. As a rule of thumb, you should initially consider reducing your discretionary or non-essential expenses.

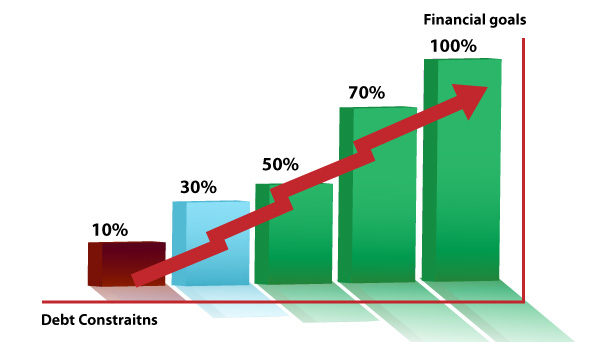

Planning your Financial Goals with Budget-iT

Professional money managers know the key to obtaining financial freedom is the creation of budget plan that maximizes your money. why is budgeting so crucial to your financial success? Quite simply, a detailed budget permits you to manage your money effectively by tracking your spending on daily, weekly and or monthly basis; thereby, allowing you to establish an affordable lifestyle and set goals for future growth.

Now that you have made the right decision to manage your personal finances, discover how easy and convenient it is to use this intuitive App by entering all income, expenses and debt accounts.

Remember to best utilize the systems calculating analytical and intuitive power you should provide as much information as possible.

If your current expending cuts are insufficient to save for your goals, review your flexible expenses and adjust those controllable items to accomplish your monthly savings target. Once you been able to trim expenses to reach the targeted amount, deposit the extra funds into an interest-bearing savings account every month until you have achieved the financial goals upon with which your budget plan was based.

How Budget-iT Works

Let’s review the simple steps which will allow you to easily create a comprehensive effectual budget plan based on your monthly income and expenses.

Start by organizing your expenses into the following three categories

1.Fixed expenses

Fixed expenses represent necessities whose monthly amounts typically are unchanged such as a mortgage or rent payment, vehicle loan or lease payment, insurances, credit card payments may also be considered a fixed expense since the minimum payment usually remain the same each month.

2.Fixed-Flexible

Flexible expenses consist of all the items that you can’t control or substitute for a less expensive alternative examples include groceries utilities and medical bills.

3.Discretionary expenses

Discretionary expenses are all those non-essentials that are not required for your day-to-day survival such as magazine subscription cable or satellite TV or that daily cup of specialty coffee.

Once you have identified all your different kind of expenses and listed all your sources of income, enter all these data into the Budget-iT App and start creating smart budgets tailored to your financial needs.

Start building smart Budgets with Budget-It App:

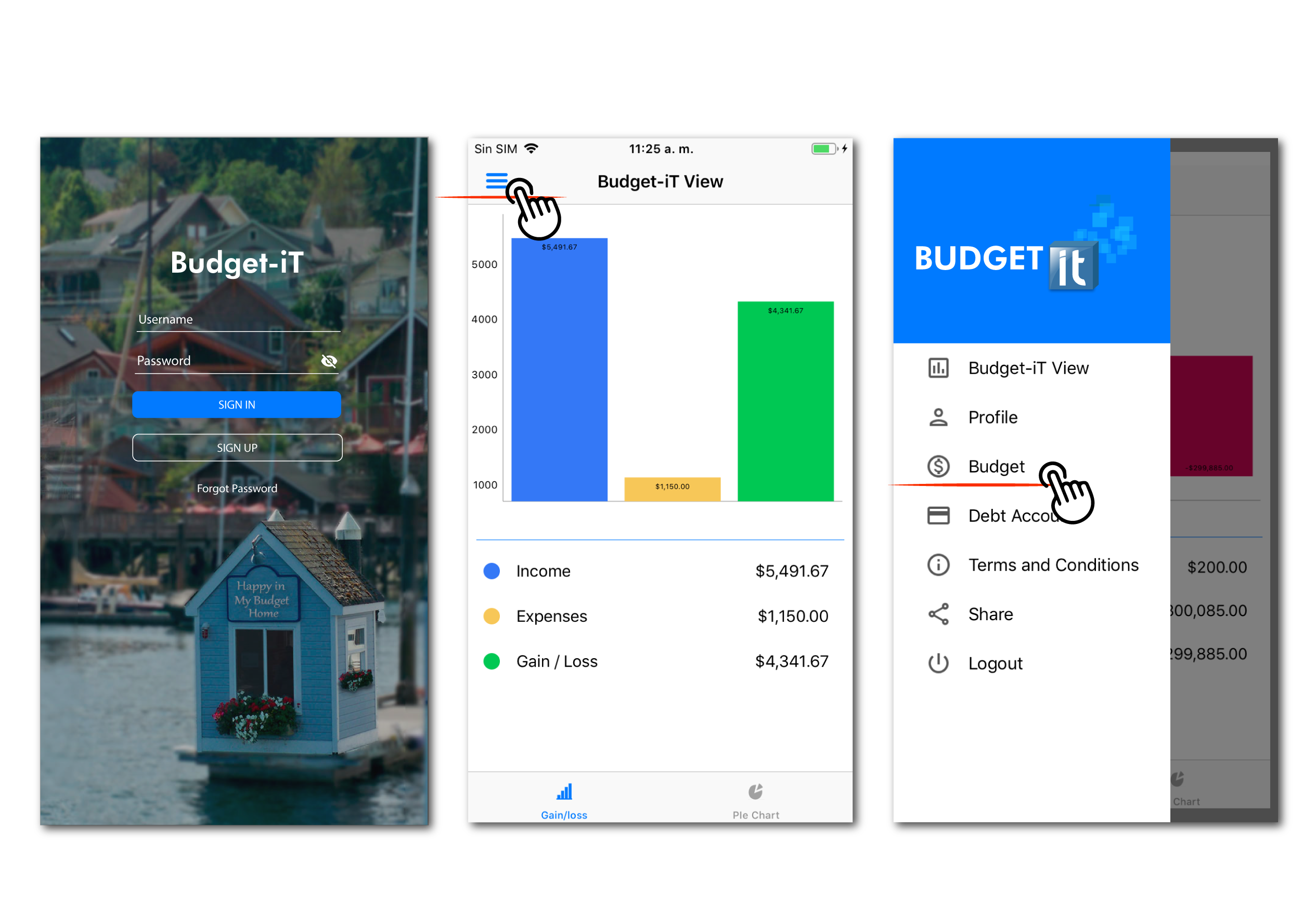

1. Download the App and create an account by signing up in through the App

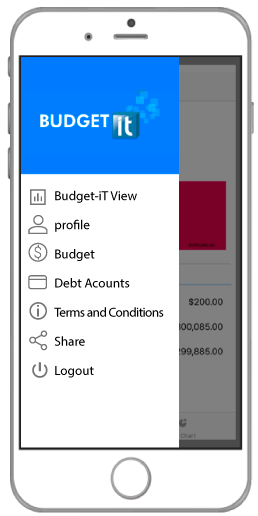

2. Tab the left-upper corner Icon to display the App Menu

3. Tab on the Budget Option to go to the Budget Section

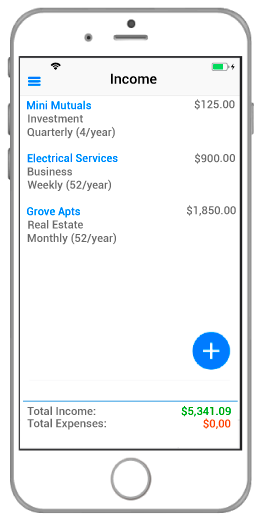

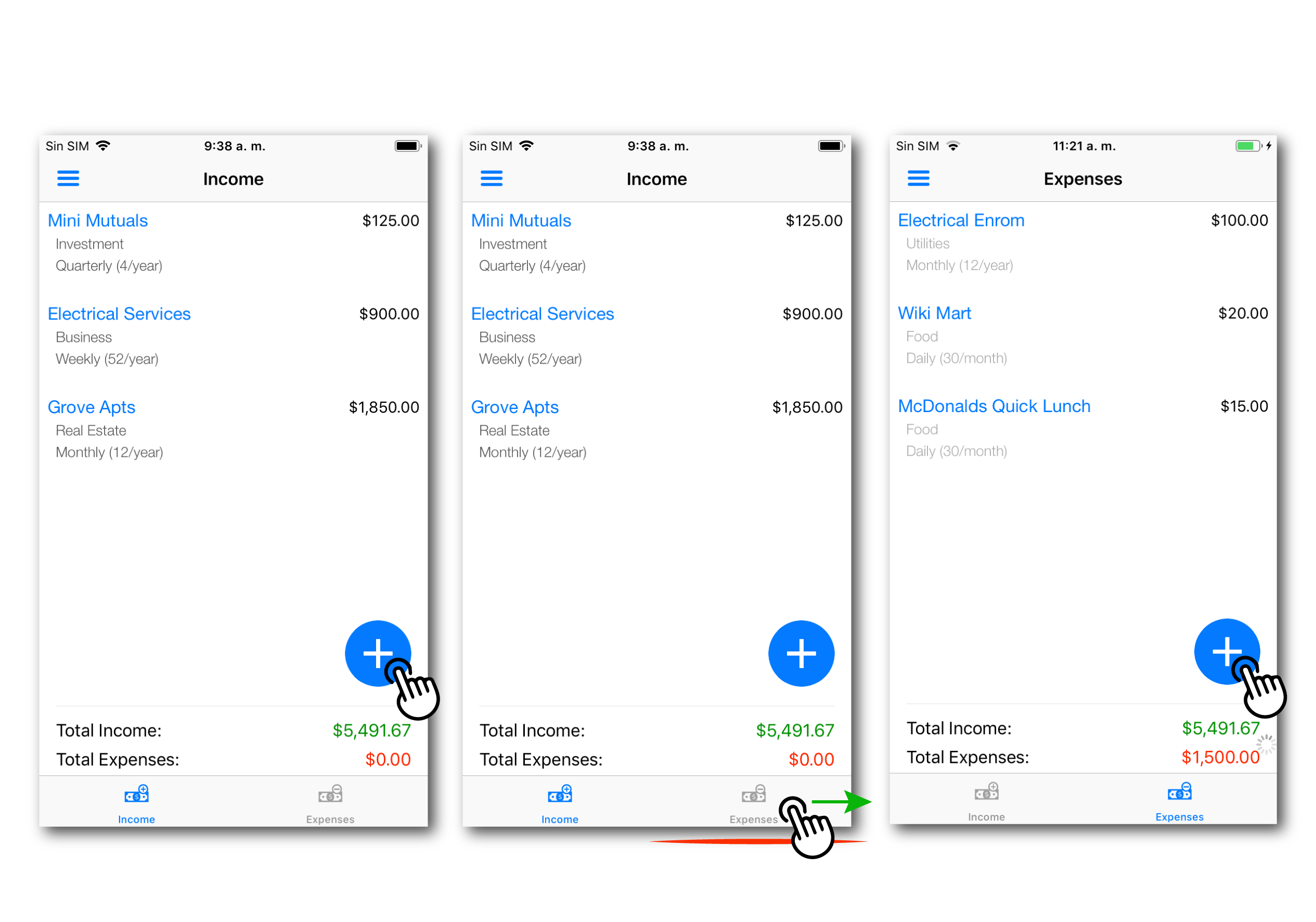

4. The Income section will become available to estar entering information

5. Tab on the blue button that has a plus sign in it to add an Income account

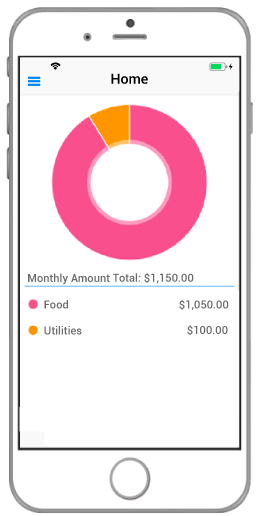

6. Tab on the Expenses Icon down the footer of the screen

7. Tab on the blue button that has a plus sign in it to add an Expense account

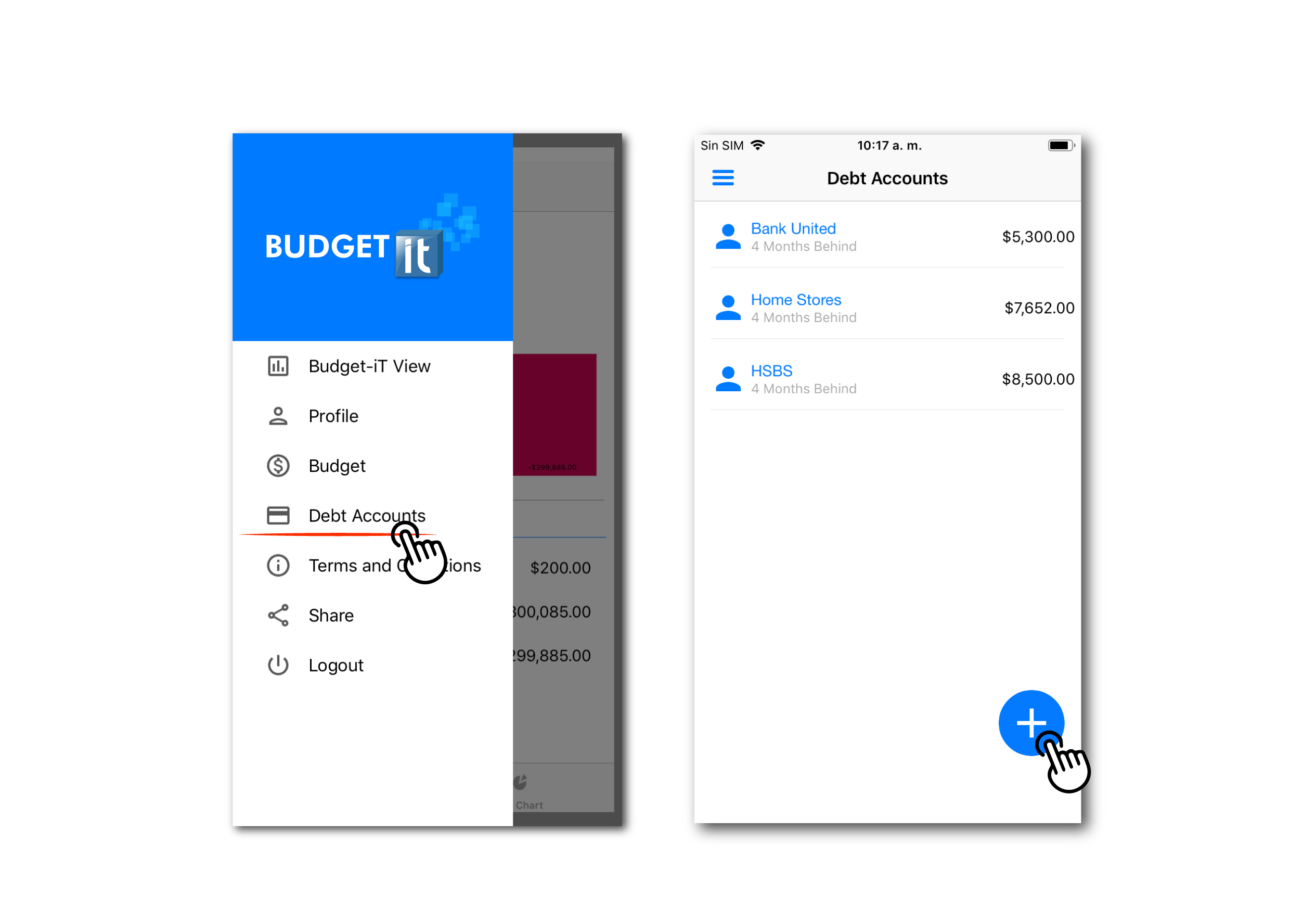

8. You can also add Debt Accounts as liabilities by displaying the App menu and following the step 2.

9. Tab on the Debt Accounts options and Tab on the blue button that has a plus sign to add a Debt account. This is useful because if you have an unpaid debt or any liability payment that is overdue, you might want to settle those unpaid debts with the FREE debt settlement App SettleiTsoft, which is availab

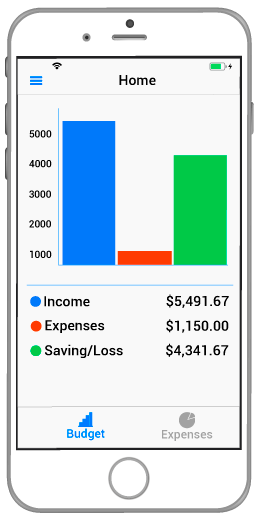

Use the Budget-iT app to list all your income in addition to any wages earned. Make certain to include alimony interest earnings dividends and any other income sources. Once you have identified all your expenses and earnings, the Budget-iT App will do the math for you. Needless to say, your overall goal is to make more money than you are spending to have a positive cash float. If your income exceeds your expenses this amount is knows as residual or disposable income. You may create a plan to allocate those funds toward a savings plan.

Luxury spending or paying off your debts faster depends a lot of your positive cash float.

If your expenses surpass your income resulting in a shortfall, beware that it’s time to make some rapid cuts in your spending’s habits.

At a minimal, you want your earnings and expenses to be equal and by doing so you have created a financial plan that account for all your need and should be easy for you to maintain.

Remember, the Budget-iT App is available free for your financial peace of mind

that have free financial management and budgeting tools that help you organize all your expenses and create a convenient history of your expenses behavior if you believe it’s time to finally take control of your finances go to this website and use their financial tools they’re easy to use and best of all they’re free to learn more please visit www.settleitsoft.com or any of the SettleiTsoft social media channels.

Legal

Terms & Conditions

Privacy

FAQ

Glossary

Contact

Contact Us

Budget-iT App

P.O. Box 17932

Fort Lauderdale FL 33818

The Budget-iT™ name, associated trademarks and logos are trademarks of SettleiTsoft, Inc., and/or its related entities, or their respective owners. Terms, conditions, features, availability, pricing, fees, service, assistance and support options are subject to change without notice. © 2019 SettleiTsoft, Inc. All Rights Reserved.